Stop settling for fiat reward programs, opt for bitcoin-back

With fiat rewards programs, customers get hung out to dry. With bitcoin rewards, you can build real value and make progress toward financial freedom.

Reward programs are ingrained into society. They are tools businesses use to entice customers to keep coming back.

But with fiat rewards programs, customers get hung out to dry.

Whether it's a points-based program or a cash-back offer, customers get rewards that come with pages and pages of hidden restrictions, have unclear value, or are denominated in melting-ice-cube dollars.

For example, what is an airline mile really worth, anyway? Do they expire? What's the fine print?

What if instead of playing fiat games with the reward programs you follow, you actually got rewards that can appreciate year over year and are distributed as you spend day to day?

With the Bold virtual Visa debit card, you get exactly that. Cold, hard, bitcoin-back on every purchase.

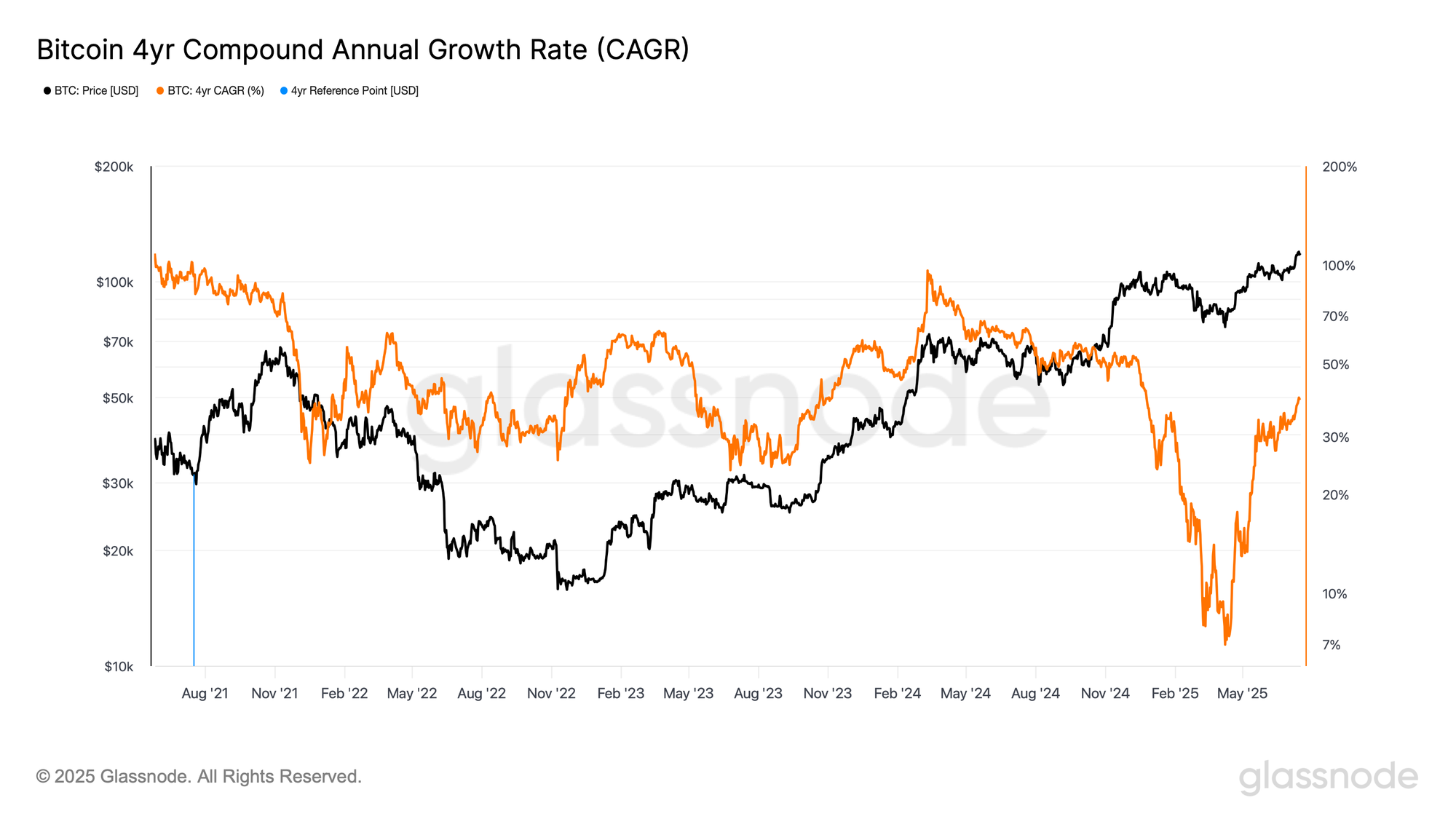

Bitcoin, a real asset with a four-year compound annual growth rate of approximately 39%.

Bitcoin, humanity's scarcest form of money, that has unlocked financial freedom for millions.

Using the Bold Card is simple and earning bitcoin rewards is easy.

The more bitcoin you buy with Bold, the higher your rewards on every purchase you make with your Bold Card.

Bold Card Rewards - Real Customer Example

Let's use a simple, real example to see the possibilities of using the Bold Card. James* is a Bold customer who has recently switched over to buying bitcoin with Bold and is using the Bold Card for his daily purchases.

- James purchases $35 of bitcoin a day on average. By the end of a month, he has purchased enough bitcoin with Bold to unlock Tier 4 of the Bold Card rewards program, earning him 2.5% bitcoin-back on every purchase.

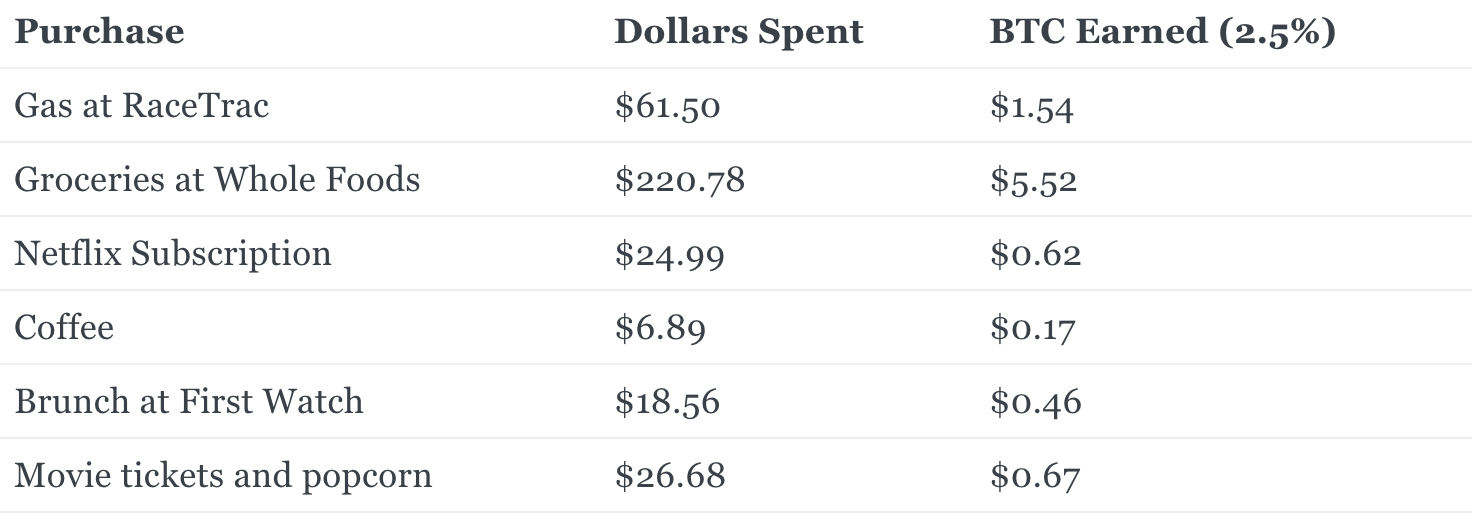

- James uses his Bold Card for day to day purchases:

- James earns bitcoin straight into his Bold account.

For ~$360 of spend, James earned about $9 in bitcoin rewards, all on purchases he would normally make. He is not tied to making sure he purchases gas from a specific gas station or coffee from some specific coffee shop. James can shop wherever he wants and still receive the same 2.5% rewards.

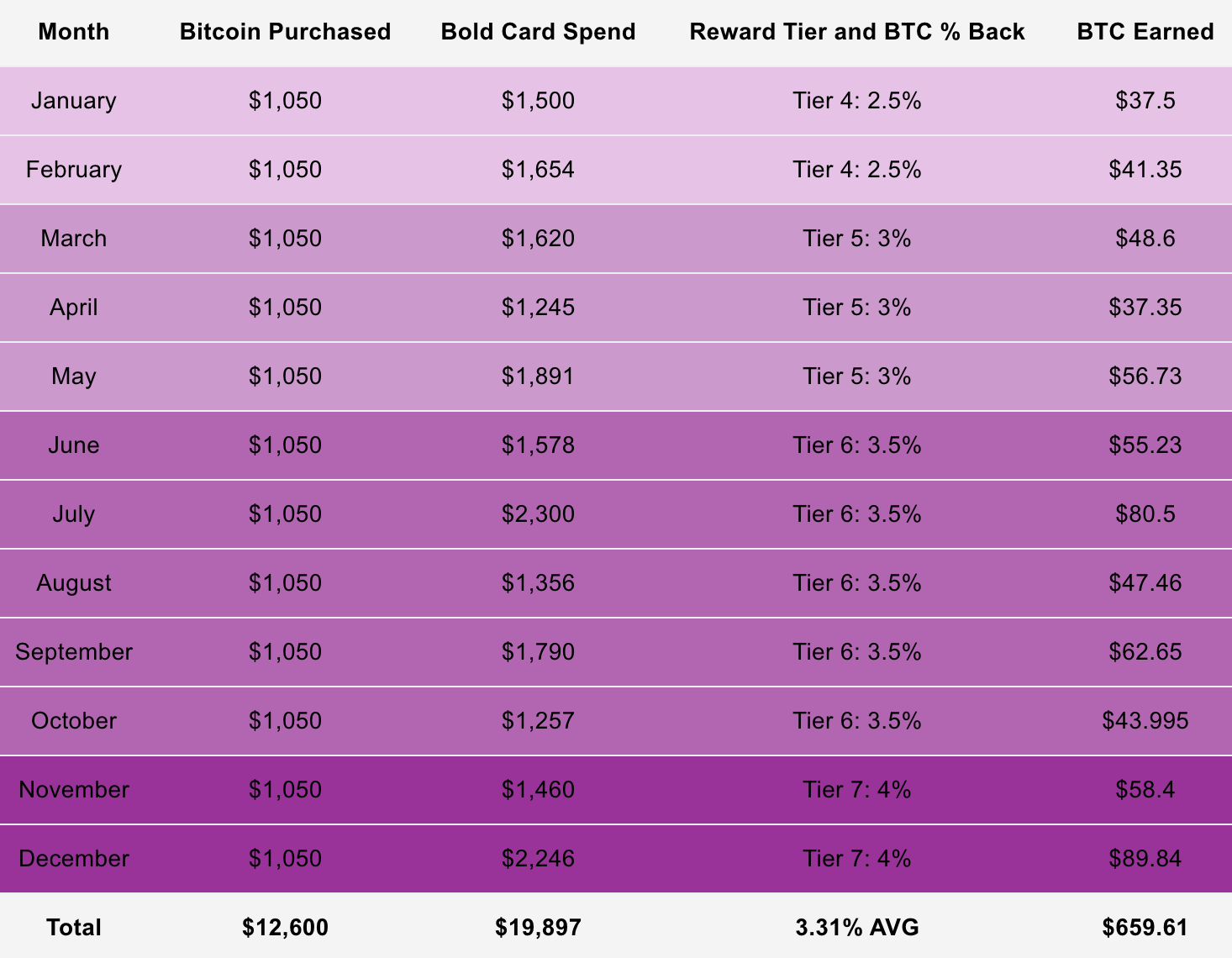

Bitcoin Rewards Earned in One Year

Now let's look at what happens if James were to do this for a whole year. Instead of just $360 in purchases, he opts to use his Bold Card for all his purchases. He also continues to purchase bitcoin through Bold and levels up his rewards tier as he does so. At the beginning of March, he realizes he is close to unlocking Tier 5, so he makes a smash buy on March 1st. Now he earns 3% bitcoin-back on all his purchases.

Remember, the more bitcoin you purchase on Bold, the higher your bitcoin-back will be.

By the end of the year, James has bought over $12,000 of bitcoin. By doing so, he has also earned $659 in additional bitcoin as rewards, just from his normal spending habits.

If bitcoin continues growing at its 4-year compound annual growth rate of 39%, and if James does nothing for the next 4 years, his $12,600 of purchased bitcoin will grow to over $47,000. His $659 in bitcoin rewards will grow to about $2,460.

James will have achieved these results simply by switching from fiat rewards to bitcoin rewards.

Give Bold a try today, and unlock bitcoin rewards for yourself.

Bold is the banking platform for bitcoiners. Earn up to 10% bitcoin-back with the Bold virtual Visa debit card. Get the industry's lowest fees on bitcoin buys and sells. Store and move dollars with the Bold checking account**. Get $25 of free bitcoin when you buy $100 of BTC or more. Pay zero fees on your first $10,000 of buys.

*James is a fictional name to protect the customer's privacy.

**Bold is a financial technology company, not a bank. Banking services are provided through Bold's partner banks; Members FDIC.